| FYI ... Thursday - Jun 26, 2008 | |

| Federal Reserve Vice Chairman Donald Kohn spoke today in Germany on the topic of whether the world economy is experiencing "decoupling" - whether changes in economic growth in one country are closely linked to growth in other countries. While he finds that there are quite a few examples of decoupling in the current world economy, he makes no new comments on the economy or monetary policy. But he does end up emphasizing the importance on constraining inflation. His limited comments related to monetary policy re-emphasize the Fed's new focus on fighting inflation and worrying less about too weak economic growth. "For the moment, higher headline rates of inflation have shown only a few tentative signs of embedding themselves in core inflation or in longer-term inflation expectations. However, policymakers around the world must monitor the situation carefully for signs that the increases in relative prices globally do not generate persistently higher inflation. Additionally, in those countries where strong commodity demands are associated with rapid growth in aggregate demand that outstrips potential supply, actions to contain inflation by restraining aggregate demand would contribute to global price stability." Kohn states that international economic integration has grown but later adds that diverges in growth remain. "As a consequence of these developments, internationally integrated production has risen. From the U.S. perspective, this rise has primarily occurred through growth in the import share of intermediate inputs used across all private industries. In the last decade alone, the imported input share rose from around 8-1/4 percent in 1997 to 10-1/2 percent by 2006." "One result of this financial integration is that the financial channels are growing in importance in the transmission of shocks between economies. The extent of this integration has become painfully evident to investors and financial institutions during the current episode of financial turmoil, with the collapse of the subprime mortgage market in the United States spreading losses and funding pressures to many corners of the globe." The vice chairman points out that economic growth has not slowed overseas a much as for the U.S. "What about our more recent experience? During the first three quarters of 2007, the U.S. economy was growing at a solid pace of about 3 percent at an annual rate. Over the next two quarters, U.S. growth slowed to an average of about 3/4 percent, while growth in other industrialized countries stayed much closer to trend rates at about 2-1/2 percent, and growth in the emerging market economies, at 6-1/2 percent, held up quite well." He sees that the sub-prime crisis did impact financial markets outside the U.S. but with nowhere near the same impact. "In contrast, some have pointed to the apparent resilience of financial conditions in emerging market economies during the past year as an example of decoupling. In particular, the disruptions in the advanced economies have had only limited impacts on money markets in emerging market economies, and other financial market indicators in emerging market economies appear to have held up relatively well." The bottom line is that Vice Chairman Kohn had some interesting insights into how economies overseas have weathered the impact of the U.S. sub-prime crisis relatively well. But he ended up not forgetting to remind everyone of the importance of being vigilant against rising inflation. -- R. Mark Rogers | |

Thursday, June 26, 2008

May Existing Home Sales Increase Slightly

by CalculatedRisk

From MarketWatch: U.S. May existing-home sales rise 2% as expected

The U.S. home and condo resales inched higher in May as prices continued to fall, the National Association of Realtors reported Thursday. Resales of U.S. houses and condos rose 2% to a seasonally adjusted annualized rate of 4.99 million in May from 4.89 million in April.Graphs soon ... (NAR is slow to release the data online again) Update MarketWatch on inventory:

Inventories of unsold homes on the market fell 1.4% to 4.49 million, a 10.8-month supply at the May sales pace. The inventory figures are not seasonally adjusted. Inventories are up 2.4% in the past year.NAR still hasn't released the data online.

Thursday, June 26, 2008

May Existing Home Sales Graphs

by CalculatedRisk

Note: for the 2nd month in a row, the NAR didn't release the Existing Home sales data online in a timely manner.

The NAR reports: May Existing-Home Sales Show Modest Gain

Existing-home sales – including single-family, townhomes, condominiums and co-ops – increased 2.0 percent to a seasonally adjusted annual rate 1 of 4.99 million units in May from a level of 4.89 million in April, but are 15.9 percent below the 5.93 million-unit pace in May 2007.

Click on graph for larger image in new window.

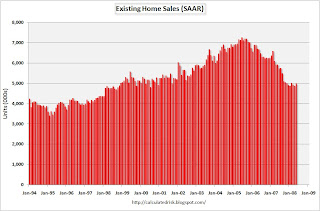

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May 2008 (4.99 million SAAR) were the weakest May since 1998 (4.77 million SAAR).

It's important to note that a large percentage of these sales are for homes that were foreclosed during the previous year. Dataquick reported that in California in May, 38.3 percent of all sales were foreclosure resales!

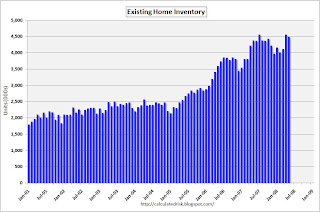

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.49 million homes for sale in May.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.49 million homes for sale in May. Total housing inventory at the end of May fell 1.4 percent to 4.49 million existing homes available for sale, which represents a 10.8-month supply at the current sales pace, down from a 11.2-month supply in April.The typical pattern is for inventory to decline in December, and then to slowly rebound in January and February, and really start to increase from March through mid-Summer.

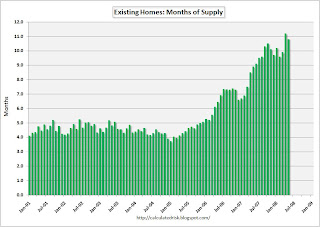

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply decreased to 10.8 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales decline later this year. More later when the raw data is available ...

No comments:

Post a Comment